Balance

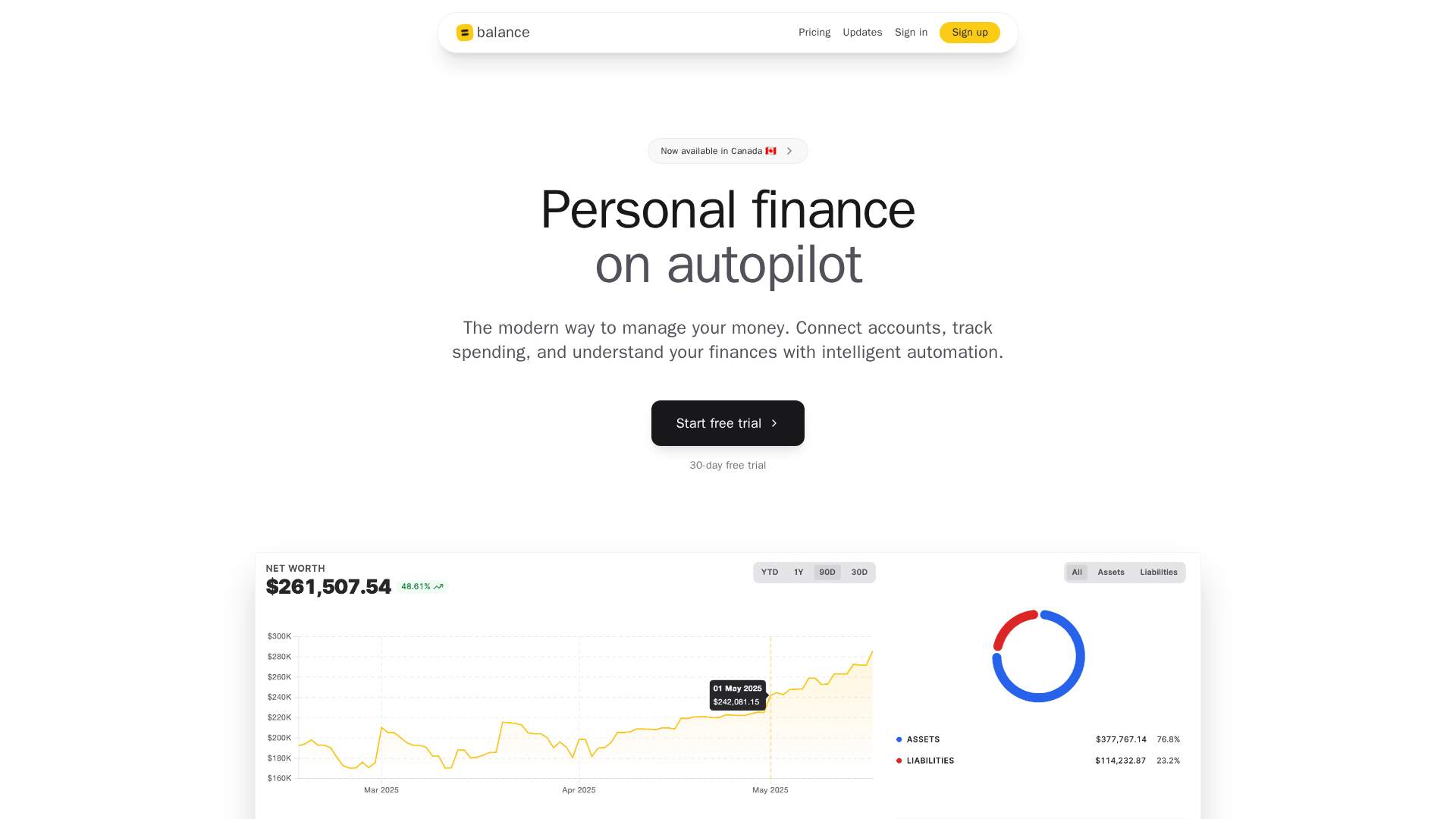

| Introduction: | Balance is a modern personal finance platform that helps users manage their money on autopilot by connecting accounts, tracking spending, and providing intelligent insights. |

| Recorded in: | 6/5/2025 |

| Links: |

What is Balance?

Balance is a modern personal finance platform designed to help individuals manage their money with intelligent automation. It provides a complete financial picture by allowing users to connect all their accounts, track transactions, monitor investments, and gain insights through an elegant, unified interface. The platform aims to simplify financial management, help users understand their spending patterns, and make informed decisions by transforming raw data into actionable insights.

How to use Balance

Users can get started with Balance by signing up for a 30-day free trial. The platform requires users to securely connect their financial accounts from over 12,000 supported institutions. Once connected, Balance automatically tracks transactions, categorizes spending, and monitors investments. Users interact with the platform through a unified dashboard, receive smart notifications like Daily Digests and Low Balance Alerts, and can create custom views for detailed analysis. A key interaction pattern involves using the AI feature to ask natural language questions about their finances and receive instant, intelligent answers. While a free trial is offered, specific pricing details beyond the trial are not explicitly stated.

Balance's core features

Securely connect to over 12,000 financial institutions

Unified dashboard to view all accounts in one place

Automatic transaction categorization and real-time monitoring

Investment portfolio tracking with real-time market data and performance analytics (Beta)

Daily Digest email for a comprehensive overview of financial activity

Customizable Low Balance Alerts to avoid overdraft fees

Custom Views with advanced filtering for personalized financial analysis

AI-powered natural language query for instant financial insights

Industry-standard data encryption for sensitive information

Strong password requirements and breach detection with upcoming two-factor authentication

Use cases of Balance

Consolidating all financial accounts (checking, savings, credit cards, investments) into a single dashboard.

Automatically categorizing spending to understand where money is going.

Monitoring investment portfolio performance and comparing against benchmarks.

Receiving daily summaries of financial activity to stay informed.

Getting alerts when account balances drop below a set threshold to prevent overdrafts.

Creating custom reports to track specific spending habits or income streams over time.

Asking natural language questions to quickly get answers about spending patterns, such as 'How much was our trip to Spain?' or 'Are we spending more on groceries than last year?'

Identifying unexpected charges or subscriptions before they impact the budget.

Analyzing income from various sources like freelance projects or side gigs.

Ensuring financial data is protected with robust security and privacy measures.